The Banking and Finance industry is one of the most heavily regulated sectors of the world. The regulations, although important to protect the integrity of the system and customer interest, come at the cost of hindered advancement and such had been the case for the industry.

This was until the rise of FinTech companies, who leveraged APIs as gateways to expose traditional financial services so that third-party developers could build custom solutions on top of them. There’s a lot you can achieve with FinTech APIs, without having to go through the labor of manually implementing any functionality.

Reflect that we are linking to on G2.com which shows there are 139 APIs listed under the tag of Financial APIs, with around 290 listed this very year.

FinTech APIs are putting immense pressure on Traditional Banking and Financial Organisations, who are actively trying to catch up. Customers today expect advanced, frictionless experiences and banks with traditional business models are failing to provide them.

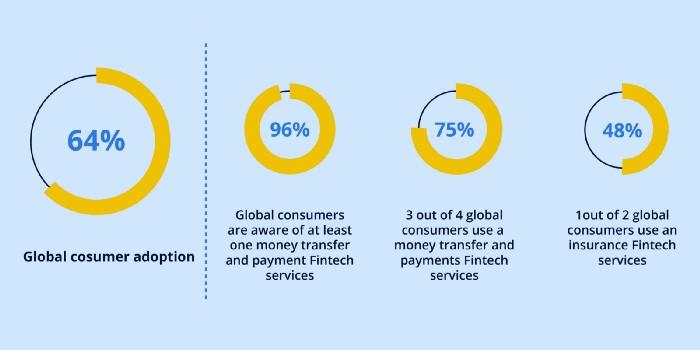

When Ernst and Young conducted their first study on FinTech adoption in 2015, they found adoption rates for FinTech as low as 10% amongst the consumers they surveyed. The number rose to 33% in 2017 and now stands at 64%. More and more individuals especially millennials, are shying away from traditional banking and instead are inclined more towards digital solutions put out by these FinTech companies.

It’s clearly time for banks to explore newer business models and to expose data and functionality in a similar fashion, acting as the infrastructure or platform on which financial services of the future are built. Else tech giants or startups in the space will ultimately wipe them over.

Open Banking and Europe’s PSD2

In 2015 the European Parliament adopted new legislation, Payment Services Directive 2 better known as PSD2, to streamline the digitalization of banks and financial services. The directive obligates banks across Europe to make banking data and services available to third-party developers, so they can build value-added services on top of them.

The concept of Open Banking, on the other hand, has been around for much longer and it suggests that banks provide access to user data via Open APIs, so that they can partner with external entities to improve customer experience.

The Open Banking Initiative is powering PSD2 today, for which deadlines are running out and banks are putting out APIs on a daily basis. The directive has provided Banks with an excellent opportunity to make their mark, tight deadlines have forced banks to work faster on API preparation, resulting in 529 Banking APIs publicly listed as of today.

Banks, because of the initiative, and the legislation are on their way to making a comeback, but is just putting out an API enough?

Developer Experience Makes APIs Useable

Developers today have a wide array of choices. A number of Banking and Finance APIs today provide the same utility and services, some implementing them in a different manner, some adopting different technology stacks, but what truly sets these APIs apart is the ease when it comes to consumption.

Developers want to get started as soon as possible, spend as little time getting acquainted with the API, and focus more on building creative solutions on top of them. In order for an API to be widely adopted, it must have a great developer experience.

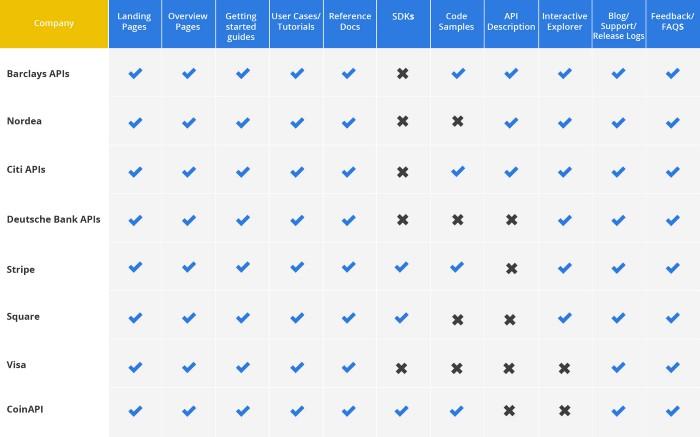

Since Developer Experience is a huge deciding factor when it comes to adopting an API, we sat down and shortlisted 8 popular Banking and Finance APIs and analyzed what they have to offer in terms of Developer Experience, and what makes them popular choices amongst developers.

Using the famous Developer Experience checklist as criteria and point of reference, we noticed some common trends and practices, which are objectively summarised in the table below:

Read in detail what forms the Developer Experience Checklist for APIs: What exactly is Developer Experience?

Quickly skimming through the table you would notice that most of these APIs offer a number of components from the Developer Experience checklist, and hence comes as no surprise why they are doing so well. One area we saw FinTech APIs lead, was with offering API implementations in multiple languages, in the form of SDKs, so developers can instantly start making use of these APIs in languages they are comfortable with.

We further ran a detailed analysis to find out how these APIs have gone about with their Developer Experience and what sets them apart from each other and remaining of the competition, which you can go through here: Popular Developer Experience Practices: FinTech and Banking APIs.

PSD2 is an Opportunity for Digital Transformation

FinTech APIs have built popularity, cashing on the exemplary experiences they provide, both to developers and customers, and Banking APIs that have followed suit have done well. But this is not the case for every bank out there. PSD2, although very explicitly requires banks to open up data and banking functionalities, it does not specify how banks are supposed to meet these requirements, with many just checking them off with bare minimum implementations.

Banks that are looking to just adhere to regulatory requirements and not do more, may miss out on big opportunities to expand and grow new business models, and may not be able to put themselves on the map with FinTech APIs.

According to a survey, only 59% of Europe’s 442 banks met PSD2’s 14th March deadline, to have a publicly available testing facility or a sandbox environment .

Of course, it is easier said than done and many banks are still struggling to prepare their APIs, with most of them slacking behind. In order to fulfill legal requirements, the API experience gets second fiddle. While understandable, it leads to a missed opportunity nonetheless

With the final 29th September deadline looming ahead, a number of Banking APIs are going to hit the markets, and only the ones that come with a developer experience will catch all the buzz, leaving the rest trailing on traction.

Automation is the Key to Scaling Developer Experience

So where does this leave API teams today who are still working on their API and have no time or resources to work on the consumption part of it?

And the answer lies in Automation.

With all hands busy on deck working on the core functionality of APIs, there is no reason that resources have to be dedicated to just work on producing the artifacts that make APIs easier to consume. Instead, let the machines do the working for you!

A lot can be done with an API Specification today. The document, when passed through CodeGen engines, can drive entire Developer Experience(DX) for APIs with automatic generation of DX components. And not just Documentation or Portals, but also complex components like SDKs, Code Samples, API Explorers and can even CI/CD pipelines so none of this has to be updated manually.

Get Started ASAP

Where are you with Developer Experience for your APIs? Pushing for that 29th September Deadline and have no idea where to get started? Don’t worry about it.

Luckily for you, here at APIMatic, this is our specialty. We hold the necessary skills and expertise to help you set up an automated Developer Experience solution, and with our in-house technology, can get you running within weeks!

You can always reach out to our team to discuss Developer Experience and we’ll help you find an easy way out that fits your need. There’s no reason you have to stay behind and not compete with the top Banking and FinTech APIs of today. Get started as soon as you can!

Thanks to Adam DuVander.